High-Resolution Weather Intelligence That Drives Energy Performance.

The Meteomatics Weather API turns weather data into a strategic advantage for energy companies. Instead of juggling fragmented sources, you get a single, high-reliability feed that delivers exactly the insights needed to forecast supply, balance the grid, protect assets, and optimize trading decisions.

| Access | API |

| Region | Global |

| Format | CSV, HTML, JSON, NetCDF, XML |

| Frequency | ≥ 5min |

| Granularity | 90 meters |

| History | ≥ 1940 |

Precision Weather Intelligence for High-Stakes Energy Decisions.

EURO1k gives energy companies the hyperlocal clarity they need to optimize renewable output, stabilize the grid, and improve trading performance, even in the most weather-sensitive regions of Europe. Instead of relying on coarse global models that blur crucial detail, EURO1k pinpoints the atmospheric dynamics that directly impact operational and commercial outcomes.

| Access | API |

| Region | Europe |

| Format | CSV, HTML, JSON, NetCDF, XML |

| Frequency | hourly |

| Granularity | Native 1 km, 15 min |

| History | ≥ 2023 |

Weather Intelligence You Can See, Understand, and Act On.

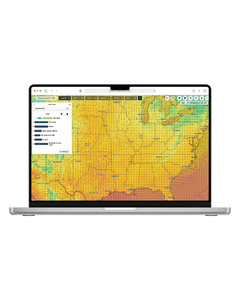

MetX turns high-resolution weather data into immediate operational awareness for energy companies. Instead of sifting through raw forecasts or static dashboards, you get a real-time, interactive view of the conditions that drive generation, demand, and risk, all powered directly by the Meteomatics Weather API.

| Access | Web Interface |

| Region | Global |

| Format | CSV, JSON |

| Frequency | ≥ 5min |

| Granularity | 90 meters |

| History | ≥ 1940 |

Asset-Specific Renewable Forecasts That Strengthen Operations and Trading Performance.

Portfolio Power Forecasts give energy companies a sharper, site-specific view of how their wind, solar, and hydro assets will perform, enabling more accurate planning, tighter risk control, and better commercial results. Instead of relying on generic model output, you get forecasts calibrated to your actual assets, continuously refined with live operational data.

| Access | sFTP |

| Region | Global |

| Format | CSV, JSON, XML |

| Frequency | 15min |

| Granularity | 90 meters |

| History | ≥ 1940 |

Proactive Weather Risk Management for Energy Assets and Markets.

Weather Alerts turn continuous weather monitoring into a practical risk-control tool, keeping your operations, grid, and market exposure ahead of rapidly changing conditions.

| Access | Email, SMS |

| Region | Global |

| Format | HTML |

| Frequency | ≥ 5min |

| Granularity | 90 meters |

The Complete Data Platform.

A unique open platform, best-in-class data and expertise - all the ingredients for executing critical data management, analytics and business intelligence decisions with confidence.

| Access | API, Cloud, Web Interface |

| Region | Africa, Asia, Europe, Middle-East, North America, South America |

| Format | Cloud formats, CSV, JSON, Python, XLS, XML |

| Frequency | Intra-Day |

| Granularity | 1min |

| History | On request |

Monitor, manage, and build forward curves.

Shape and model curves on demand. Create precise mathematical curves for risk modeling, pricing algorithms, and data interpolation with ease.

| Access | API, Cloud, Web Interface |

| Region | Africa, Asia, Europe, Middle-East, North America, South America |

| Format | Cloud formats, CSV, JSON, Python, XLS, XML |

| Frequency | End-of-Day |

| Granularity | 15min |

| History | On request |

Discover, buy and monetise data.

Our marketplace provides access to premium data sources, supporting asset allocation decisions, portfolio construction, and advanced risk and performance analysis.

| Access | API, Cloud, Web Interface |

| Region | Africa, Asia, Europe, Middle-East, North America, South America |

| Format | Cloud formats, CSV, JSON, Python, XLS, XML |

| Frequency | Intra-Day |

| Granularity | 1min |

| History | On request |

Connect. Integrate. Succeed.

Comprehensive APIs are at the heart of where data meets integration and becomes reality, with the flexibility to connect and create real business value. Integrate Ventriks data seamlessly into your applications with our powerful, developer-friendly APIs. Get started in minutes with comprehensive documentation and code examples.

| Access | API |

| Region | Africa, Asia, Europe, Middle-East, North America, South America |

| Format | Cloud formats, CSV, JSON, Python, XLS, XML |

| Frequency | Intra-Day |

| Granularity | 1min |

| History | On request |

Infinite Quality Rules.

We help you manage data quality challenges. End-to-end data quality management with ownership, lineage tracking, reporting, and automated workflows.

| Access | API, Cloud, Web Interface |

| Region | Africa, Asia, Europe, Middle-East, North America, South America |

| Format | Cloud formats, CSV, JSON, Python, XLS, XML |

Weather Intelligence That Powers Energy Markets.

Make smarter trading decisions, optimize renewable operations, and forecast demand with precision. Access the world's most advanced weather models, real-time market aggregates, and AI-powered insights designed for energy professionals. Get access to weighted energy forecasts, dynamic global weather maps, point forecast analysis, and now, Oracle.

Oracle allows users to query very specific requests, which unlocks new dimensions for individual modification and a broad range of different use cases. From setting up trading nudges to generating a visualized overview of your renewable energy assets - with Oracle, you can do it all! Now available on the Jua Platform.

| Access | API, Web Interface |

| Region | Global |

| Format | HTML, JSON, SaaS |

| Frequency | Real-time |

| Granularity | hourly |

| History | On request |

Weather API for Developers.

Integrate our powerful weather forecasting capabilities directly into your applications with comprehensive API access to all weather models. Unlock smarter decisions across trading, renewable operations, and demand forecasting. With just a few clicks, you can access Jua’s cutting-edge EPT-2 models, rely on established numerical weather predictions, or explore next-generation AI-powered forecasts such as Microsoft Aurora or GraphCast – and even combine them for maximum accuracy. Our transparent, usage-based pricing ensures that you only pay for the data you actually query, giving you full flexibility and cost control.

Interested? Read more here.

| Access | API |

| Region | Global |

| Format | JSON, Xarray, Zarr |

| Frequency | Real-time |

| Granularity | hourly |

| History | On request |

Our most precise model yet: Hedge against weather forcasting uncertainties with EPT-2 Ensemble.

EPT-2e is Jua’s state-of-the-art, 30-member ensemble model designed for fully probabilistic forecasting. By clearly outperforming long-standing benchmarks like the HRES and ECMWF ensemble means, it redefines accuracy and reliability in medium- to long-range weather predictions. For energy traders, this means sharper demand forecasts, better risk hedging, and stronger confidence in long-horizon positions. Updated daily—and available via platform, API, or SDK—EPT-2e delivers the insights you need to optimize trading strategies and navigate volatile markets with precision.

| Access | API, Web Interface |

| Region | Global |

| Format | HTML, JSON, SaaS |

| Frequency | Real-time |

| Granularity | hourly |

| History | On request |

Always get the latest weather data with Rapid Refresh

EPT-2 Rapid Refresh is Jua’s fastest global forecast, updated 24 times per day—every single hour. Powered by direct satellite observations, it delivers real-time accuracy far beyond traditional models that refresh only four times daily. For spot energy traders, Rapid Refresh means staying ahead of sudden weather shifts, optimizing intraday positions, and making confident calls in volatile markets.

| Access | API, Web Interface |

| Region | Global |

| Format | HTML, JSON, SaaS |

| Frequency | Real-time |

| Granularity | hourly |

| History | On request |

Seize Every Market Opportunity. Optimise Every Trade. Instantly.

Fast to deploy, fast to profit. Seize every opportunity with Hansen Trade, the 100% cloud-native platform that goes live in weeks, not months. Empower traders to build and optimise strategies without a single line of code. From Nord Pool and EPEX SPOT to regional TSOs, stay ahead with real-time automation and optimisation without the IT overhead.

Leverage Hansen's proven capabilities in managing time-series, contract, and market communication data to seamlessly automate all your trading, balance, settlement, and billing operations. Hansen delivers analytics-driven optimisation of short-term trading across all markets, providing unique market insights that maximise trading across all asset classes.

With Hansen, trading organisations automate end-to-end dynamic trading using a next-generation logic engine, leveraging inputs such as price, weather, consumption forecasts, and real-time disruptions to maximise business performance.

Hansen offers the power to transform in a market where the only constant is change: Consolidate, Visualise, Create, Automate, and Optimise.

| Access | API, Cloud, Web Interface |

| Region | Europe |

| Format | SaaS |

Cloud SaaS Data Management Platform.

Turn complex data into clarity

OpenDataDSL is a cloud-native, ultra-scalable platform designed to transform how businesses manage, model, and interact with market data. By combining transparency, extensibility, and advanced automation, it empowers teams to go beyond the limits of legacy systems.

Why OpenDataDSL?

ODSL Programming Language – A unique domain-specific language that lets “business coders” easily query, transform, and automate workflows with market data.

Operational Transparency – Built-in dashboards, dataset monitoring, and curve management provide unmatched visibility and control across the entire data pipeline.

Extensible by Design – Both the web application and ODSL are designed for partners and clients to create pluggable extensions, ensuring the platform grows with your business.

Cloud-Native & Scalable – Zero-deployment, SaaS-first architecture that adapts seamlessly to your workloads—delivering performance without hidden costs.

Smarter Curves – Advanced curve building tools that use business rules and AI-driven logic to create accurate forward curves, faster.

The Open in OpenDataDSL

Open is more than just a name—it’s a philosophy. We believe in transparency, honesty, and giving customers the ability to build their own insights, KPIs, and workflows without being locked into rigid, opaque platforms.

Shaping the Future of Market Data

With over two decades of expertise in market data systems, OpenDataDSL is built for energy, commodities, and beyond—helping companies unlock real-time analytics, embrace AI, and gain a competitive edge in a rapidly evolving landscape.

| Access | API, Browser, Cloud, Excel, Web Interface |

| Region | Global |

| Format | CSV, HTML, JSON, SaaS, XLS, XML |

Make Energy Data Your Strategic Advantage.

Hansen EDM addresses the complexity and scale of modern energy markets. Designed with the Nordic and broader European markets in mind, Hansen EDM delivers high-performance data processing, secure integration with market hubs, and full compliance with regional regulations and data hubs. Whether you're managing millions of daily meter reads or supporting advanced billing, settlement, and analytics, Hansen EDM empowers your team with the speed, accuracy, and agility needed to thrive in a data-driven future.

In today's energy landscape, data is more than just a by-product – it's a business-critical asset. Meter readings and market transactions generate massive volumes of time-series data that must be validated, processed, and made available in real-time for energy providers. Regulatory demands are rising, customer expectations are evolving, and the pressure to optimise operations has never been higher, which drives the demand for grid-grade energy data management.

| Access | API, Cloud, Web Interface |

| Region | Europe |

| Format | SaaS |

‘Demand Forecasts’ by Yes Energy enable you to make the most informed decisions possible when buying and selling in organized wholesale markets in Europe, New Zealand, Australia, Japan, Philippines, North America, and other regions.

Generated with proprietary forecasting engines, ‘Demand Forecasts’ by Yes Energy feed comprehensive weather variables and calendar information to proprietary algorithms. The advanced regression models use detailed demand and weather observation history and incorporate the latest near-term data to respond to changing weather patterns, extreme weather events, and holidays that might impact energy demand. This is all backed by an expert team of analysts and engineers reviewing and maintaining every model, ensuring the most accurate and reliable forecasting in the industry.

| Access | API, Cloud, Web Interface |

| Region | Asia, Australia, Europe, New Zealand, North America |

| Format | CSV, HTML, JSON, XLS, XML |

| Frequency | hourly |

| Granularity | 15min |

| History | ≥ 2019 |

Maximize the Revenue Potential of Your Renewable Energy Park with SAMA-Asset.

SAMA-Asset is an integrated platform offering end-to-end management for wind and solar park energy trading.

From production forecasting to portfolio optimization, proprietary wholesale trading strategies, optimal bidding and market execution, SAMA-AssetTM platform offers highly profitable trading strategies to maximize the financial value of your assets. Our strategies now extend across 12 European markets.

| Access | Web Interface |

| Region | Europe |

| Format | SaaS |

| Frequency | 15min |

| Granularity | 15min |

| History | On request |

Analytics-Ready ISO Power Market Data to Fuel Trading Strategies.

North American Power Market Data’ by Yes Energy is the most comprehensive, high-frequency collection of North American power market data available — purpose-built to support energy analytics, forecasting, risk management, and quantitative trading. With coverage spanning from each Independent System Operator’s (ISO) inception to real-time operations today, Yes Energy data enables users to analyze market behavior with both deep historical context and real-time insights.

| Access | Amazon S3, API, Cloud, Web Interface |

| Region | North America |

| Format | CSV, HTML, JSON, XLS, XML |

| Frequency | Near-real-time |

| Granularity | Near-real-time |

| History | ≥ 2003 |

Battery Storage Trading as a Service with SAMA-BATT.

SAMA-BATT optimizes battery storage with advanced deep learning algorithms.

SAMA-BATT provides and executes real-time bidding and seamlessly integrates with day-ahead, intraday, and balancing markets such as mFRR, aFRR and FCR, enhancing efficiency and profitability.

| Access | Web Interface |

| Region | Europe |

| Format | SaaS |

| Frequency | 15min |

| Granularity | 15min |

| History | On request |

Providing essential infrastructure that connects clients to markets, globally. We offer extensive market access and platform access, underpinned by exceptional client service.

| Markets | Spot, Derivatives |

| Exchanges | EEX, EPEX, HUDEX, HUPX, SEEPEX, SEMOpx, Others |

| Commodities | Power, Gas, Emissions, Freight |

| Currencies | EUR, USD, GBP, Others |

Capitalize on Energy Market Opportunities with SAMA-Strategies.

SAMA-Strategies is asset-independent and allows you to capitalize on market opportunities through our proprietary statistical arbitrage trading strategies. SAMAWATT’s strategies, including zero-imbalance trading, have an excellent proven track record in 12 European markets.

| Access | Web Interface |

| Region | Europe |

| Format | SaaS |

| Frequency | ≥ 1min |

| Granularity | 15min |

| History | On request |

Become a member of Raiffeisenbank Czech Republic’s client group that we have been serving in commodity clearing since 2008.

Our product is growing together with our clients and with ECC. We started in the local Czech market with one client only and now after 16 years of experience in this field we cover almost all of Europe from Ireland to Turkey, both in terms of products and clients.

| Markets | Spot, Derivatives, Auctions |

| Exchanges | EEX, EPEX, HUDEX, HUPX, NOREXECO, SEEPEX, SEMOpx, Others |

| Commodities | Power, Gas, Emissions |

| Currencies | EUR, USD, GBP, Others |

Robust SaaS solution for algorithmic trading and trading desk automation.

Volue Algo Trader is a robust SaaS solution for automated intraday power trading. The software offers proven out-of-the-box algorithmic execution strategies with extensive parametrisation and customisation possibilities to maximise your trading desk P&L from Day 1. With a significant share of intraday volumes in Europe’s main power exchanges traded through Volue Algo Trader, it is the trusted partner for a broad range of energy market participants from local utilities to traders, retailers and multinational energy majors.

| Access | API, Cloud |

| Region | Europe |

| Format | SaaS |

| Frequency | Real-time |

| Granularity | 15min |

| History | Historical market data and backtesting available |

Connecting clients to markets for 100 years.

We are an institutional-grade financial services franchise that provides global market access, clearing and execution, trading platforms and more to our clients worldwide. As a leading global FCM with roots dating back a century, our comprehensive suite of institutional-grade futures clearing & execution services delivers broad exchange access and transparency to our clients worldwide. StoneX’s robust back-office infrastructure enables us to manage all your clearing and allocation needs with a high degree of efficiency and expertise.

Our clearing services, which include physical delivery, helps our clients mitigate risk and reduce costs, while ensuring transparency in the global marketplace.

| Markets | Derivatives |

| Exchanges | EEX, Others |

| Commodities | Power, Gas, Emissions, Freight |

| Currencies | EUR, USD, GBP, Others |

Flexible APIs that take in unstructured chat data from any platform and integrate easily with existing systems.

Sense Street ingests chat data sent in bulk at the end of each day and sends back a structured ouput. The data is processed in batch, quality controlled, and ready for use next morning. Allows to populate CRM systems and database automatically with missed trades and client cares, run compliance checks, enrich reporting, and much more.

| Access | API |

| Region | Global |

| Frequency | T+1 |

| Granularity | In Batch |

High performance SaaS C/ETRM solution.

Igloo is a high-performance SaaS solution designed in collaboration with one of the world’s largest financial energy traders. It offers a state-of-the art user experience, unrivalled exchange connectivity and automated trading of exceptionally high trade volumes.

Built for ease of use, efficiency, control and scalability, Igloo helps curve trading desks for power, oil, gas, LNG, coal and emissions operate with maximum productivity.

| Access | Desktop Application, Web Interface |

| Region | Europe, UK |

| Format | HTML |

| Frequency | Real-time |

| Granularity | 15, 30 or 60 min, daily, monthly |

Award winning trader’s dashboard for short-term power markets.

PowerDesk is an award-winning SaaS power trader's dashboard for intraday and day-ahead markets.

Offering intelligent visualisation of real-time P&L and market connectivity from one central place, traders are empowered to optimise revenues from generation assets faster.

| Access | API, Dashboard, Web Interface |

| Region | Europe, UK |

| Frequency | Real-time |

| Granularity | 15, 30 or 60 min |

Automated production planning and trading.

Automation and asset optimisation are key to capture the value of your assets in the power markets. By automating and optimising the production planning and trading process, Volue’s new Smart Power software suite contributes to increased revenues.

| Access | API, Cloud |

| Region | Europe |

| Format | SaaS |

| Frequency | Real-time |

| Granularity | 15min |

| History | Historical data available |

Integrate API calls to Sense Street directly into any real-time workflow (sales-trader workflow, book building). Help the front and middle-office in automating the booking of their voice trades throughout the day.

Remove manual and redundant transcription of information contained in chats and free up valuable human time.

| Access | API |

| Region | Global |

| Frequency | Real-time |

| Granularity | 1 second upon request |

European power scheduling made easy.

PowerDesk Scheduler is a power scheduling solution that is compliant with the communications protocols and message formats used by the majority of TSOs across Europe.

The solution supports automation of cross border and internal nominations, enabling scheduling teams to meet TSO country specific gate closure deadlines and stay in-balance.

| Access | Desktop Application |

| Region | AL, AT, BA, BE, BG, CH, CZ, DE, DK, Europe, FR, FI, GB, GR, HR, HU, IE, IT, LU, ME, MK, NL, NO, PL, RO, RS, SE, SI, SK, UK, XK |

| Format | TSO formats |

| Frequency | Real-time |

| Granularity | 15, 30 or 60 min |

Our AI-powered forecasting solutions let you track, plan and optimize your energy needs for the evolving power markets.

Amperon provides AI-powered electricity forecasting and analytics solutions for every electron on the grid. With best-in-class data management infrastructure and consistent AI/ML models at its core, Amperon improves grid reliability, manages financial risk, optimizes renewables, and accelerates decarbonization.

| Access | API, Web Interface |

| Region | Australia, DE, DK, ES, FR, GB, IE, IT, NL, North America, PT |

| Format | CSV, HTML |

| Frequency | hourly |

| Granularity | hourly |

| History | ≥ 2021, On request |

Intelligent visualisation of power balances and flows.

PowerDesk Balancer provides real-time visualisation of market balances comprising trades, forecasts, and flows.

The solution helps to take advantage of trading opportunities right up to gate closure, whilst executing balancing strategies and managing capacities.

| Access | Desktop Application |

| Region | AL, AT, BA, BE, BG, CH, CZ, DE, DK, Europe, FR, FI, GB, GR, HR, HU, IE, IT, LU, ME, MK, NL, NO, PL, RO, RS, SE, SI, SK, UK, XK |

| Format | Trade forecast formats |

| Frequency | Real-time |

| Granularity | 15, 30 or 60 min |

Avoid time-consuming ad-hoc requests after entering an energy market.

Time2Market offers a complete market management package to ensure you spend minimal time on fulfilling administrative requirements toward the markets you are already trading.

Please note that Market Continuity is only available for markets which Time2Market has provided market access to, as we cannot guarantee the quality of the entry service otherwise.

| Access | Email, Physical Meeting, Virtual Meeting |

| Region | Australia, Europe, North America |

| Format | CSV, PDF |

Energy Market Partners - not just another market entry service provider!

Once you have identified an opportunity, you are already behind. That’s why, we are always one step ahead. We analyze the market and present a clear strategy based on the most promising potential, while factoring in when, how and in which order you will secure the best results with your unique setup in mind. We offer solutions for all the European and North American power and gas markets.

| Access | Direct Phone, Email, Physical Meeting, Virtual Meeting |

| Region | Europe, North America |

Energy One's award-winning Energy Trading and Risk Management solution for UK and European energy markets.

enTrader is a multi-commodity, multi-user, time-series based system that supports the full trade lifecycle from deal capture and risk management through to settlement processes. This ETRM software allows users to evaluate portfolios in real-time including market and credit risk, cash-flows and P&L all subject to limit monitoring.

As a modular system, it is scalable to adapt to growing business needs. It is built for European energy markets and has the design and architecture to provide for both scalability and extensibility to meet client requirements, both now and in the future.

| Access | Desktop Application, Web Interface |

| Region | Europe, UK |

| Frequency | Real-time |

| Granularity | 15, 30 or 60 min |

| History | On request |

Market leading physical power trading platform.

PowerDesk Data Manager is a leading power trading communications and operations platform.

The solution supports asset and meter data management, trading and settlements, with market connectivity in the Nordics, Europe, Western Australia and Canada (Ontario).

| Access | Desktop Application |

| Region | DE, DK, Europe, FI, NO, SE, UK |

| Granularity | 15, 30 or 60 min |

Energy One provides 24/7 or Out-of-Hours gas and power operations and dispatching services.

Our team of 40+ experienced gas and power operators works out of three control rooms based in Paris (France), Aalst (Belgium) and Adelaide (Australia) using a follow-the-sun approach. This means that we ensure you always have operators working in daytime hours to manage nominations, bidding, scheduling and portfolio balancing on your behalf. Several of our experts have moved from our European offices to Australia, where they are taking care of the European night shift, ensuring you always have a fresh pair of eyes watching over your portfolio.

| Access | Direct Phone, Email, sFTP, Web Interface |

| Region | Australia, Europe, UK |

| Format | CSV, JSON, XLS, XML |

| Frequency | Real-time |

| Granularity | 5, 15, 30 or 60 min |

| History | Full history available, daily handover reports and audit logs |

With its user-friendly interface, available algorithms and vast range of parameters, you can easily optimise your intraday positions and available flexibilities.

Energy One's comprehensive suite of trading modules empowers companies to seamlessly automate their trading activities across Auction bidding and Continuous markets. As a leading Independent Software Vendor (ISV) serving multiple exchanges, we also offer full integration with our advanced scheduling modules, enabling our clients to concentrate on their unique needs and strategic goals, letting the system manage all the nominations requirements and technical connections with NEMOs.

| Access | Web Interface |

| Region | Europe, UK |

| Format | CSV, JSON, XLS, XML |

| Frequency | Real-time |

| Granularity | 15, 30 or 60 min |

| History | On request |

Pioneering algorithmic power trading.

Designed to boost short-term power trading strategies, PowerDesk Edge offers a toolkit of innovative, low code algorithm libraries with risk control at its core.

Don’t be held back by the limitations of augmented manual trading, whether use of ‘if-this-then-that’ algorithms or black box’ AI solutions. With PowerDesk Edge you can enjoy the flexibility of deploying bespoke algorithms, whilst applying rigorous back testing to validate your trading strategies.

Be empowered to achieve continuous and structured trading performance gains, whilst providing the transparency sought by compliance and risk departments."

| Access | Web Interface |

| Region | Europe, UK |

| Frequency | Real-time |

| Granularity | 15, 30 or 60 min |

Energy data, analysis and forecasts at a glance - edited for purchase managers in German language.

ISPEX Kompass provides market information to purchase managers across industries. Data meets editorial content in a unique fashion, allowing for fast and comprehensive understanding of key price drivers and latest developments. Technical purchasing signals support decision making as does our integrated Charting tool. As an essential toolbox for risk management based on information related to energy ISPEX Kompass is accompanied by our energy market analysis as well as our interactive webinar 'Energiefrühstück' on a monthly basis. Please note: We offer our services primarily in German.

| Access | Web Interface |

| Region | DE, Europe |

| Format | HTML |

| Frequency | daily |

| Granularity | hourly, daily |

| History | up to 25 years |

Better-Built Data.

The CargoMetrics Commodity Packs measure global seaborne commodity trade by country, comprising more than 90% of global import and export trade volume. Product packs include Coal, Crude Oil, Grains, Iron Ore, LNG, LPG, Palm Oil, and Refined Oil.

| Access | Amazon Data Exchange |

| Region | Global |

| Format | CSV |

| Frequency | daily |

| Granularity | daily, weekly, monthly |

| History | ≥ 2013 |

SaaS for nominations, scheduling and balancing your portfolio across Europe's energy markets.

eZ-Ops handles nominations, balancing and scheduling across most of Europe's gas and power grids, as well as power exchanges. We support and maintain communication lines with practically every TSO, SSO, Hub, Exchange and Market Operator in Europe. Potential add-ons include algo-trading, auction bidding and asset scheduling which are discussed our 'eZ-Ops | Automated Trading' page.

| Access | Web Interface |

| Region | Europe, UK |

| Format | CSV, JSON, TSO formats, XLS, XML |

| Frequency | Real-time |

| Granularity | 15, 30 or 60 min |

| History | On request |

Comprehensive 24/7 outsourced gas and power operations and dispatching services.

Outsourcing your nominations and dispatching functions to GMSL allows you to concentrate on commercial activities to maximise value from your portfolio. We have unrivalled experience of operations in gas and power markets across Europe.

In case of new requirements or changes to existing markets we have a Business Analysis Team plus a Training & Improvement Team, dedicated to building our experience and spreading best practice throughout GMSL.

Our shift team numbers over 50 staff, providing flexibility for peaks in workload, together with holidays and illness.

| Access | API, Email, sFTP, Web Interface |

| Region | Europe |

| Format | CSV, JSON, XLS, XML |

| Frequency | Real-time |

| Granularity | As per market requirements |

Power generation forecasts enable the integration of wind and solar energy into power grids and energy markets. enercast PFS is designed to deliver accurate forecasts for individual plants or entire wind or solar parks.

Based on plant data, historical meter data and operational data provided by the customer, as well as up to 10 weather models, enercast PFS forecasts the power output for anywhere between 15 minutes and 31 days ahead.

The resulting forecasts are delivered in real time in a variety of formats via e-mail, FTP and a powerful API. The forecasts can also be visualized and configured through the enercast portal.

| Access | API, Email, FTP, sFTP, Web Interface |

| Region | Asia, AT, BE, BG, CH, CZ, DE, DK, ES, Europe, FR, FI, GB, Global, GR, HU, IE, IT, JP, LU, NL, NO, North America, PL, PO, PT, RO, RS, RU, SE, SI, SK, TR, UK, US |

| Format | CSV, HTML, JSON |

| Frequency | ≥ 15min |

| Granularity | ≥ 15min |

| History | On request |

Accurate forecasts enable optimal usage of the energy produced by small-scale photovoltaic installations. enercast SEF Smart Energy Forecast allows you to integrate power generation forecasts into monitoring and energy management systems with minimum effort through an efficient API.

Based on technical data of the plant and weather forecasts from globally leading numerical weather prediction models, enercast SEF computes the expected PV generation for the next hours and days.

| Access | API |

| Region | Asia, AT, BE, BG, CH, CZ, DE, DK, ES, Europe, FR, FI, GB, Global, GR, HU, IE, IT, JP, LU, NL, NO, North America, PL, PO, PT, RO, RS, RU, SE, SI, SK, TR, UK, US |

| Format | JSON |

| Frequency | ≥ 5min |

| Granularity | 5, 15, 30 or 60 min |

| History | On request |

The Ultimate Interface for Commodity Trading.

The frontend is a technologically advanced multi-asset screen tailor-made for Commodity Trading, Internal Trading, Sales Trading and Data Capture. It includes all the necessary tools, like smart order types & algorithmic trading solutions - making it cutting-edge for traders.

| Access | API, Dashboard |

| Region | Global |

| Exchanges | CME, EEX, EPEX Spot, ETPA, ICE, Nasdaq, Nord Pool, Others |

| Format | Java |

| Frequency | Real-time |

| Granularity | Tick-data |

| History | Historical data and backtesting on request |