Portfolio Power Forecasts

Asset-Specific Renewable Forecasts That Strengthen Operations and Trading Performance.

Portfolio Power Forecasts give energy companies a sharper, site-specific view of how their wind, solar, and hydro assets will perform, enabling more accurate planning, tighter risk control, and better commercial results. Instead of relying on generic model output, you get forecasts calibrated to your actual assets, continuously refined with live operational data.

Built and maintained by Meteomatics’ energy meteorologists, these forecasts are trained on your historical production data to capture the true behavior of each site: terrain influences, wake interactions, shading effects, turbine response patterns, and other performance characteristics that off-the-shelf models simply miss. Once operational, the system ingests plant data, updating forecasts every 15 minutes and adapting to changing conditions as they unfold.

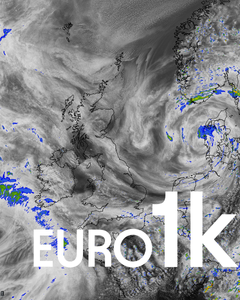

When combined with high-resolution EURO1k modeling (1 km / 15-minute granularity across Europe), the result is an ever higher level of precision.

Forecasts are delivered securely via SFTP and integrate seamlessly with control systems, trading desks, and analytics environments, giving your team the decision-ready power data they need, exactly when they need it.

| Access | sFTP |

| Region | Global |

| Format | CSV, JSON, XML |

| Frequency | 15min |

| Granularity | 90 meters |

| History | ≥ 1940 |

What is provided

> Custom-tailored power forecasts for wind, solar, and hydropower assets.

> Model calibration using your historical and live asset data.

> AI-enhanced corrections to capture terrain, shading, and operational influences.

> Forecasts for individual sites, aggregated portfolios, or national-scale operations.

> 15-minute temporal resolution and 15-minute update frequency.

> Secure, automated delivery via SFTP.

Advantages

> Lower imbalance costs through more accurate, continuously updated predictions.

> More confident trading strategies backed by asset-specific performance modeling.

> Better intraday and day-ahead planning with forecasts that adapt as conditions shift.

> Higher operational efficiency by automating the forecast pipeline and reducing manual work.

> Improved asset management through clear visibility into expected vs. actual output.

How to connect

> sFTP

Meteomatics Portfolio Power Forecasts

Visit our website to learn more about our complete suite of products.

Prices

Prices are tailored to your use case.

Contact Us

| Department | Sales |

| Phone | +49 30 200 74 280 |

| sales@meteomatics.com | |

| Website | www.meteomatics.com |

Meteomatics

High-Accuracy Weather Intelligence for Generation, Grid, and Trading.

Meteomatics provides the energy industry with the most accurate, high-resolution weather data available, enabling smarter decisions from generation to grid management and trading. By combining proprietary weather models, cutting-edge Meteodrone observations, and a fast and flexible API, Meteomatics transforms atmospheric complexity into clear, actionable insights. Utilities, traders, and renewable operators worldwide rely on Meteomatics to optimize production, anticipate demand, manage risk and cut costs, achieving greater efficiency, resilience, and profitability in a rapidly changing climate.

Across Europe, leading energy companies such as Shell, TotalEnergies, EDF, Enel, Engie, Iberdrola, Axpo, Fortum, Swissgrid, and BKW trust Meteomatics to power their forecasting, trading, and operational decision-making with unparalleled weather intelligence.

More Services from Meteomatics

High-Resolution Weather Intelligence That Drives Energy Performance.

The Meteomatics Weather API turns weather data into a strategic advantage for energy companies. Instead of juggling fragmented sources, you get a single, high-reliability feed that delivers exactly the insights needed to forecast supply, balance the grid, protect assets, and optimize trading decisions.

Precision Weather Intelligence for High-Stakes Energy Decisions.

EURO1k gives energy companies the hyperlocal clarity they need to optimize renewable output, stabilize the grid, and improve trading performance, even in the most weather-sensitive regions of Europe. Instead of relying on coarse global models that blur crucial detail, EURO1k pinpoints the atmospheric dynamics that directly impact operational and commercial outcomes.

Weather Intelligence You Can See, Understand, and Act On.

MetX turns high-resolution weather data into immediate operational awareness for energy companies. Instead of sifting through raw forecasts or static dashboards, you get a real-time, interactive view of the conditions that drive generation, demand, and risk, all powered directly by the Meteomatics Weather API.

Asset-Specific Renewable Forecasts That Strengthen Operations and Trading Performance.

Portfolio Power Forecasts give energy companies a sharper, site-specific view of how their wind, solar, and hydro assets will perform, enabling more accurate planning, tighter risk control, and better commercial results. Instead of relying on generic model output, you get forecasts calibrated to your actual assets, continuously refined with live operational data.

Proactive Weather Risk Management for Energy Assets and Markets.

Weather Alerts turn continuous weather monitoring into a practical risk-control tool, keeping your operations, grid, and market exposure ahead of rapidly changing conditions.