High-Resolution Weather Intelligence That Drives Energy Performance.

The Meteomatics Weather API turns weather data into a strategic advantage for energy companies. Instead of juggling fragmented sources, you get a single, high-reliability feed that delivers exactly the insights needed to forecast supply, balance the grid, protect assets, and optimize trading decisions.

| Access | API |

| Region | Global |

| Format | CSV, HTML, JSON, NetCDF, XML |

| Frequency | ≥ 5min |

| Granularity | 90 meters |

| History | ≥ 1940 |

Precision Weather Intelligence for High-Stakes Energy Decisions.

EURO1k gives energy companies the hyperlocal clarity they need to optimize renewable output, stabilize the grid, and improve trading performance, even in the most weather-sensitive regions of Europe. Instead of relying on coarse global models that blur crucial detail, EURO1k pinpoints the atmospheric dynamics that directly impact operational and commercial outcomes.

| Access | API |

| Region | Europe |

| Format | CSV, HTML, JSON, NetCDF, XML |

| Frequency | hourly |

| Granularity | Native 1 km, 15 min |

| History | ≥ 2023 |

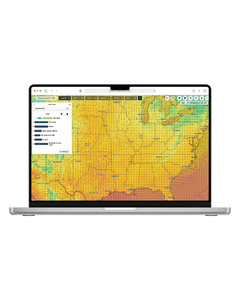

Weather Intelligence You Can See, Understand, and Act On.

MetX turns high-resolution weather data into immediate operational awareness for energy companies. Instead of sifting through raw forecasts or static dashboards, you get a real-time, interactive view of the conditions that drive generation, demand, and risk, all powered directly by the Meteomatics Weather API.

| Access | Web Interface |

| Region | Global |

| Format | CSV, JSON |

| Frequency | ≥ 5min |

| Granularity | 90 meters |

| History | ≥ 1940 |

Asset-Specific Renewable Forecasts That Strengthen Operations and Trading Performance.

Portfolio Power Forecasts give energy companies a sharper, site-specific view of how their wind, solar, and hydro assets will perform, enabling more accurate planning, tighter risk control, and better commercial results. Instead of relying on generic model output, you get forecasts calibrated to your actual assets, continuously refined with live operational data.

| Access | sFTP |

| Region | Global |

| Format | CSV, JSON, XML |

| Frequency | 15min |

| Granularity | 90 meters |

| History | ≥ 1940 |

Proactive Weather Risk Management for Energy Assets and Markets.

Weather Alerts turn continuous weather monitoring into a practical risk-control tool, keeping your operations, grid, and market exposure ahead of rapidly changing conditions.

| Access | Email, SMS |

| Region | Global |

| Format | HTML |

| Frequency | ≥ 5min |

| Granularity | 90 meters |

The Complete Data Platform.

A unique open platform, best-in-class data and expertise - all the ingredients for executing critical data management, analytics and business intelligence decisions with confidence.

| Access | API, Cloud, Web Interface |

| Region | Africa, Asia, Europe, Middle-East, North America, South America |

| Format | Cloud formats, CSV, JSON, Python, XLS, XML |

| Frequency | Intra-Day |

| Granularity | 1min |

| History | On request |

Monitor, manage, and build forward curves.

Shape and model curves on demand. Create precise mathematical curves for risk modeling, pricing algorithms, and data interpolation with ease.

| Access | API, Cloud, Web Interface |

| Region | Africa, Asia, Europe, Middle-East, North America, South America |

| Format | Cloud formats, CSV, JSON, Python, XLS, XML |

| Frequency | End-of-Day |

| Granularity | 15min |

| History | On request |

Discover, buy and monetise data.

Our marketplace provides access to premium data sources, supporting asset allocation decisions, portfolio construction, and advanced risk and performance analysis.

| Access | API, Cloud, Web Interface |

| Region | Africa, Asia, Europe, Middle-East, North America, South America |

| Format | Cloud formats, CSV, JSON, Python, XLS, XML |

| Frequency | Intra-Day |

| Granularity | 1min |

| History | On request |

Connect. Integrate. Succeed.

Comprehensive APIs are at the heart of where data meets integration and becomes reality, with the flexibility to connect and create real business value. Integrate Ventriks data seamlessly into your applications with our powerful, developer-friendly APIs. Get started in minutes with comprehensive documentation and code examples.

| Access | API |

| Region | Africa, Asia, Europe, Middle-East, North America, South America |

| Format | Cloud formats, CSV, JSON, Python, XLS, XML |

| Frequency | Intra-Day |

| Granularity | 1min |

| History | On request |

Infinite Quality Rules.

We help you manage data quality challenges. End-to-end data quality management with ownership, lineage tracking, reporting, and automated workflows.

| Access | API, Cloud, Web Interface |

| Region | Africa, Asia, Europe, Middle-East, North America, South America |

| Format | Cloud formats, CSV, JSON, Python, XLS, XML |

Weather Intelligence That Powers Energy Markets.

Make smarter trading decisions, optimize renewable operations, and forecast demand with precision. Access the world's most advanced weather models, real-time market aggregates, and AI-powered insights designed for energy professionals. Get access to weighted energy forecasts, dynamic global weather maps, point forecast analysis, and now, Oracle.

Oracle allows users to query very specific requests, which unlocks new dimensions for individual modification and a broad range of different use cases. From setting up trading nudges to generating a visualized overview of your renewable energy assets - with Oracle, you can do it all! Now available on the Jua Platform.

| Access | API, Web Interface |

| Region | Global |

| Format | HTML, JSON, SaaS |

| Frequency | Real-time |

| Granularity | hourly |

| History | On request |

Weather API for Developers.

Integrate our powerful weather forecasting capabilities directly into your applications with comprehensive API access to all weather models. Unlock smarter decisions across trading, renewable operations, and demand forecasting. With just a few clicks, you can access Jua’s cutting-edge EPT-2 models, rely on established numerical weather predictions, or explore next-generation AI-powered forecasts such as Microsoft Aurora or GraphCast – and even combine them for maximum accuracy. Our transparent, usage-based pricing ensures that you only pay for the data you actually query, giving you full flexibility and cost control.

Interested? Read more here.

| Access | API |

| Region | Global |

| Format | JSON, Xarray, Zarr |

| Frequency | Real-time |

| Granularity | hourly |

| History | On request |

Our most precise model yet: Hedge against weather forcasting uncertainties with EPT-2 Ensemble.

EPT-2e is Jua’s state-of-the-art, 30-member ensemble model designed for fully probabilistic forecasting. By clearly outperforming long-standing benchmarks like the HRES and ECMWF ensemble means, it redefines accuracy and reliability in medium- to long-range weather predictions. For energy traders, this means sharper demand forecasts, better risk hedging, and stronger confidence in long-horizon positions. Updated daily—and available via platform, API, or SDK—EPT-2e delivers the insights you need to optimize trading strategies and navigate volatile markets with precision.

| Access | API, Web Interface |

| Region | Global |

| Format | HTML, JSON, SaaS |

| Frequency | Real-time |

| Granularity | hourly |

| History | On request |

Always get the latest weather data with Rapid Refresh

EPT-2 Rapid Refresh is Jua’s fastest global forecast, updated 24 times per day—every single hour. Powered by direct satellite observations, it delivers real-time accuracy far beyond traditional models that refresh only four times daily. For spot energy traders, Rapid Refresh means staying ahead of sudden weather shifts, optimizing intraday positions, and making confident calls in volatile markets.

| Access | API, Web Interface |

| Region | Global |

| Format | HTML, JSON, SaaS |

| Frequency | Real-time |

| Granularity | hourly |

| History | On request |

Cloud SaaS Data Management Platform.

Turn complex data into clarity

OpenDataDSL is a cloud-native, ultra-scalable platform designed to transform how businesses manage, model, and interact with market data. By combining transparency, extensibility, and advanced automation, it empowers teams to go beyond the limits of legacy systems.

Why OpenDataDSL?

ODSL Programming Language – A unique domain-specific language that lets “business coders” easily query, transform, and automate workflows with market data.

Operational Transparency – Built-in dashboards, dataset monitoring, and curve management provide unmatched visibility and control across the entire data pipeline.

Extensible by Design – Both the web application and ODSL are designed for partners and clients to create pluggable extensions, ensuring the platform grows with your business.

Cloud-Native & Scalable – Zero-deployment, SaaS-first architecture that adapts seamlessly to your workloads—delivering performance without hidden costs.

Smarter Curves – Advanced curve building tools that use business rules and AI-driven logic to create accurate forward curves, faster.

The Open in OpenDataDSL

Open is more than just a name—it’s a philosophy. We believe in transparency, honesty, and giving customers the ability to build their own insights, KPIs, and workflows without being locked into rigid, opaque platforms.

Shaping the Future of Market Data

With over two decades of expertise in market data systems, OpenDataDSL is built for energy, commodities, and beyond—helping companies unlock real-time analytics, embrace AI, and gain a competitive edge in a rapidly evolving landscape.

| Access | API, Browser, Cloud, Excel, Web Interface |

| Region | Global |

| Format | CSV, HTML, JSON, SaaS, XLS, XML |

Providing essential infrastructure that connects clients to markets, globally. We offer extensive market access and platform access, underpinned by exceptional client service.

| Markets | Spot, Derivatives |

| Exchanges | EEX, EPEX, HUDEX, HUPX, SEEPEX, SEMOpx, Others |

| Commodities | Power, Gas, Emissions, Freight |

| Currencies | EUR, USD, GBP, Others |

Become a member of Raiffeisenbank Czech Republic’s client group that we have been serving in commodity clearing since 2008.

Our product is growing together with our clients and with ECC. We started in the local Czech market with one client only and now after 16 years of experience in this field we cover almost all of Europe from Ireland to Turkey, both in terms of products and clients.

| Markets | Spot, Derivatives, Auctions |

| Exchanges | EEX, EPEX, HUDEX, HUPX, NOREXECO, SEEPEX, SEMOpx, Others |

| Commodities | Power, Gas, Emissions |

| Currencies | EUR, USD, GBP, Others |

Connecting clients to markets for 100 years.

We are an institutional-grade financial services franchise that provides global market access, clearing and execution, trading platforms and more to our clients worldwide. As a leading global FCM with roots dating back a century, our comprehensive suite of institutional-grade futures clearing & execution services delivers broad exchange access and transparency to our clients worldwide. StoneX’s robust back-office infrastructure enables us to manage all your clearing and allocation needs with a high degree of efficiency and expertise.

Our clearing services, which include physical delivery, helps our clients mitigate risk and reduce costs, while ensuring transparency in the global marketplace.

| Markets | Derivatives |

| Exchanges | EEX, Others |

| Commodities | Power, Gas, Emissions, Freight |

| Currencies | EUR, USD, GBP, Others |

Real-time EU and UK ETS emissions monitoring.

Kayrros Carbon Watch provides realtime physical demand for EU & UK carbon credits by country and sector, including live industrial emissions, with unmatched accuracy by leveraging satellite imagery and AI.

| Access | API, Email, Web Interface |

| Region | EU, UK |

| Format | JSON, XLS |

| Frequency | daily |

| Granularity | daily |

| History | > 2016 |

Flexible APIs that take in unstructured chat data from any platform and integrate easily with existing systems.

Sense Street ingests chat data sent in bulk at the end of each day and sends back a structured ouput. The data is processed in batch, quality controlled, and ready for use next morning. Allows to populate CRM systems and database automatically with missed trades and client cares, run compliance checks, enrich reporting, and much more.

| Access | API |

| Region | Global |

| Frequency | T+1 |

| Granularity | In Batch |

High performance SaaS C/ETRM solution.

Igloo is a high-performance SaaS solution designed in collaboration with one of the world’s largest financial energy traders. It offers a state-of-the art user experience, unrivalled exchange connectivity and automated trading of exceptionally high trade volumes.

Built for ease of use, efficiency, control and scalability, Igloo helps curve trading desks for power, oil, gas, LNG, coal and emissions operate with maximum productivity.

| Access | Desktop Application, Web Interface |

| Region | Europe, UK |

| Format | HTML |

| Frequency | Real-time |

| Granularity | 15, 30 or 60 min, daily, monthly |

Integrate API calls to Sense Street directly into any real-time workflow (sales-trader workflow, book building). Help the front and middle-office in automating the booking of their voice trades throughout the day.

Remove manual and redundant transcription of information contained in chats and free up valuable human time.

| Access | API |

| Region | Global |

| Frequency | Real-time |

| Granularity | 1 second upon request |

Better-Built Data.

The CargoMetrics Maritime Emissions - EU ETS Carbon Tracker reports daily tons of maritime carbon (CO2) emissions that are subject to the European Union Emissions Trading System (EU ETS), the world’s leading greenhouse gas trading scheme. The Maritime Emissions - EU ETS Carbon Tracker is derived from our industry leading digital representation of the physical characteristics and real-world operation of vessels.

| Access | Amazon Data Exchange |

| Region | Europe |

| Format | CSV |

| Frequency | daily |

| Granularity | daily |

| History | ≥ 2013 |

Better-Built Data.

The CargoMetrics Maritime Emissions - Global Benchmark products represent the most comprehensive and insightful carbon (CO2) emissions and fuel consumption data available. The products are derived from our industry leading digital representation of the physical characteristics and real-world operation of vessels and are available by vessel class (tanker, dry bulk, container) and vessel size in daily, weekly, and monthly versions.

| Access | Amazon Data Exchange |

| Region | Global |

| Format | CSV |

| Frequency | daily |

| Granularity | daily, weekly, monthly |

| History | ≥ 2013 |

Energy data, analysis and forecasts at a glance - edited for purchase managers in German language.

ISPEX Kompass provides market information to purchase managers across industries. Data meets editorial content in a unique fashion, allowing for fast and comprehensive understanding of key price drivers and latest developments. Technical purchasing signals support decision making as does our integrated Charting tool. As an essential toolbox for risk management based on information related to energy ISPEX Kompass is accompanied by our energy market analysis as well as our interactive webinar 'Energiefrühstück' on a monthly basis. Please note: We offer our services primarily in German.

| Access | Web Interface |

| Region | DE, Europe |

| Format | HTML |

| Frequency | daily |

| Granularity | hourly, daily |

| History | up to 25 years |

The Ultimate Interface for Commodity Trading.

The frontend is a technologically advanced multi-asset screen tailor-made for Commodity Trading, Internal Trading, Sales Trading and Data Capture. It includes all the necessary tools, like smart order types & algorithmic trading solutions - making it cutting-edge for traders.

| Access | API, Dashboard |

| Region | Global |

| Exchanges | CME, EEX, EPEX Spot, ETPA, ICE, Nasdaq, Nord Pool, Others |

| Format | Java |

| Frequency | Real-time |

| Granularity | Tick-data |

| History | Historical data and backtesting on request |

The e*star Algorithmic Trading Solution offers flexible infrastructure for automating trading processes. Customers can use out-of-the-box features or develop their own sophisticated trading algorithms .The algo control panel allows users to configure, start, stop, and pause algorithms, and the rights management system ensures control over where and what algorithms may trade.

| Access | API, Dashboard |

| Region | Global |

| Exchanges | CME, EEX, EPEX Spot, ETPA, ICE, Nasdaq, Nord Pool, Others |

| Format | Java |

| Frequency | Real-time |

| Granularity | Tick-data |

| History | Historical data and backtesting on request |

The e*star Market Place is a full-fledged trading platform operated by a commodity trading company.

Additional to internal trading, it also supports order routing to external execution venues by leveraging the external market access provided by e*star Energy Trader.

| Access | API, Dashboard |

| Region | Global |

| Exchanges | CME, EEX, EPEX Spot, ETPA, ICE, Nasdaq, Nord Pool, Others |

| Format | Java |

| Frequency | Real-time |

| Granularity | Tick-data |

| History | Historical data and backtesting on request |

Powering the Future of Energy and Commodity Analytics

Are you still using spreadsheets, old software, or building one-off analytics? Our modern analytics platform enables portfolio and risk managers to do more, faster. The cQuant analytics platform is cloud-native, accessible from anywhere, and requires minimal set up time. The cQuant Analytics Platform provides simulation based analytics of prices, assets, contracts and entire portfolios. cQuant enables companies to plan, optimize and manage their energy and commodity portfolio.

Access our Analytics Platform for:

- Price forecasting & simulation

- Total Portfolio Analysis

- Renewable & carbon analysis

- Battery storage optimization

- Portfolio optimization

- Hedge optimization

- Risk assessment

| Access | Web Interface |

| Region | Europe, North America |

| Format | CSV, HTML |

| Frequency | daily |

| Granularity | hourly, daily |

| History | 2016 |

The e*star Live Data Portal is an advanced application that offers thorough and real-time market coverage.

With seamless connectivity to all important venues, the Live Data Portal provides users with access to various exchange and broker market data feeds, allowing them to stay up-to-date with the latest market developments. By providing access to the whole curve.

| Access | API, Dashboard |

| Region | Global |

| Exchanges | CME, EEX, EPEX Spot, ETPA, ICE, Nasdaq, Nord Pool, Others |

| Format | Java |

| Frequency | Real-time |

| Granularity | Tick-data |

| History | Historical data and backtesting on request |

e*star Market Adapter is a modular solution that offers a central point of information for trades and real-time market data.

It provides all data fields from the underlying markets - distributing trade and market data through multiple channels to feed systems of any size, from a simple Excel sheet to a full-blown position management system.

| Access | API, Dashboard |

| Region | Global |

| Exchanges | CME, EEX, EPEX Spot, ETPA, ICE, Nasdaq, Nord Pool, Others |

| Format | Java |

| Frequency | Real-time |

| Granularity | Tick-data |

| History | Historical data and backtesting on request |

UniCredit Bank AG offers clearing services for power, natural gas and emission allowances, traded at partner exchanges of the European Commodity Clearing (ECC).

| Markets | Spot, Derivatives |

| Exchanges | EEX, EPEX, HUDEX, HUPX, NOREXECO, SEEPEX, SEMOpx, Others |

| Commodities | Power, Gas, Emissions |

| Currencies | EUR, USD, GBP, Others |

Essential news and background information on the German and European Energy Markets

The energate messenger english edition provides the most essential news and background information on the German and European energy markets in a daily e-mail news letter and on the website. In addition, the reader has access to an archive with more than 22.000 articles on energy-related news. The topics range from market & companies, politics, electri-city, gas & heat to trends in technology and mobility. energate messenger english edition is aimed at readers interested in the German energy transition who work at energy companies, grid operators and tech companies, those active in politics and associations, as well as investors, consultants and financial service providers.

| Access | Email, Web Interface |

| Region | AT, CH, DE |

| Format | HTML, PDF |

| Frequency | daily |

| Granularity | hourly, daily |

| History | > 2002 |

General Clearing Member (GCM) service for energy markets cleared by ECC.

KELER CCP is a complex service provider from the heart of the CEE region, having an EMIR licence as a CCP and a GCM status by ECC as well for more than 10 years. We are here to support you with all our expertise in the clearing industry we accumulated since the foundation in 2008. KELER CCP offers clearing of spot and intraday power, power futures, CO2, GOO, spot gas and gas futures products on the following trading venues: EEX, EPEXSPOT, HUDEX, HUPX, NOREXECO, SEEPEX and SEMOpx.

| Markets | Spot, Derivatives |

| Exchanges | EEX, EPEX, HUDEX, HUPX, NOREXECO, SEEPEX, SEMOpx, Others |

| Commodities | Power, Gas, Emissions |

| Currencies | EUR, GBP, Others |

The Desktop App enables users to receive real-time commodity and transparency data.

Historical and real-time data for trading, order book and transparency data as well as prices, volumes and indices are provided. The Desktop App includes real-time commodity quotes, dynamic commodity charting software, real-time forward curve construction, options analytics, real-time alerts and access to technical studies and trend analyses.

| Access | Desktop Application |

| Region | AT, BE, BG, CH, CZ, DE, ES, FR, GB, HU, IT, JP, NL, NO, PL, RO, RS, SE, SI, SK |

| Format | HTML |

| Frequency | Real-time |

| Granularity | < 15min |

| History | > 2018 |