Four workable ways for industrial companies to reduce their energy bill

14 December 2022

Introduction

Let’s face it, we have probably entered a 20-year cycle of high and volatile energy prices.

For energy-intensive companies, this is a strong incentive to double-down on net zero initiatives. But the expected return on these initiatives, while significant, is often quite distant. Reengineering products, converting factories, migrating supply bases… takes time.

Does it mean that you should wait and suffer in silence — or turn off the lights?

We don’t think so!

Our experience working with world leaders in heavy industries like oil and gas, cement and metals shows that industrial companies often overlook four workable ways to reduce their energy bill:

1. Sweating your assets

Sweating our assets, trading around our assets, asset optimization…

These concerns from procurement and financial managers suggest that for them, the coordination between external and internal buying decision

factors is not as tight as it should be.

Here is what we see happening again and again:

Companies keep imposing new constraints, rules, targets… to energy buyers, on top of the old cost and risk-management objectives…

…and these many internal decision parameters create buying conundrums — challenges with multiple optimum solutions

Resolving such challenges by hand or in Excel is not realistic, especially when the parameters keep changing.

In our experience, using a proper solver to find the optimal combination of internal decision parameters will reduce your energy bill by 1-2%.

And ensuring the internal optimum is consistent with energy market conditions will generate further savings of 2-3%.

That’s what we call sweating your assets!

For example, one of Datapred’s clients is a large biodiesel maker whose energy spend depends in part on the mix of vegetable oils it is using. But that mix also conditions raw material costs, and the biodiesel’s quality and sustainability indices.

Current energy prices should clearly affect the resolution of that operational trade-off - It would be a shame to miss out on an energy-friendly optimum.

2. Proactively managing price adjustment formulas

The typical price adjustment formula is the same in every industry, for every raw material and energy:

- Select a reference price, for example EEX’s TTF DA spot price for natural gas in Europe.

- Agree with your supplier that your price for month M+1 will be the average reference price over month M.

Such arrangements leave two avenues for improvement and cost savings.

- Anticipate upcoming price adjustments and advance/delay transactions accordingly. As an average of spot prices, the reference price will be smoother and easier to predict. You should take advantage, if you have the ability to advance or delay some of your energy transactions.

- Proactively negotiate the price adjustment formula. Depending on market conditions and your own operational flexibility, small changes to the formula could yield sizable benefits. A quarterly average of the reference price instead of a monthly average, a reference price mixing spot and forward prices instead of being based on spot prices only…

For example, assuming the same consumption pattern in April, May and June of these years, a factory buying TTF gas at spot prices would have paid 21% less with a monthly vs. quarterly price adjustment formula in 2019, 33% less in 2020, but 16% more in 2021. Proactively managing price adjustment formulas is thus a good example of an energy cost saving tactic that requires a bit more analytical power than Excel, but remains manageable and can yield nice savings.

3. Playing with the mix of futures contracts

While the energy hedging strategies of industrial companies are more diverse than their price-adjustment formulas, they are often equally rigid (more information on this) — renewing short execution windows, static coverage periods and limited pool of futures contracts year after year.

It’s a pity, since in our experience, introducing a little bit of responsiveness to the hedging process is a powerful energy cost saver.

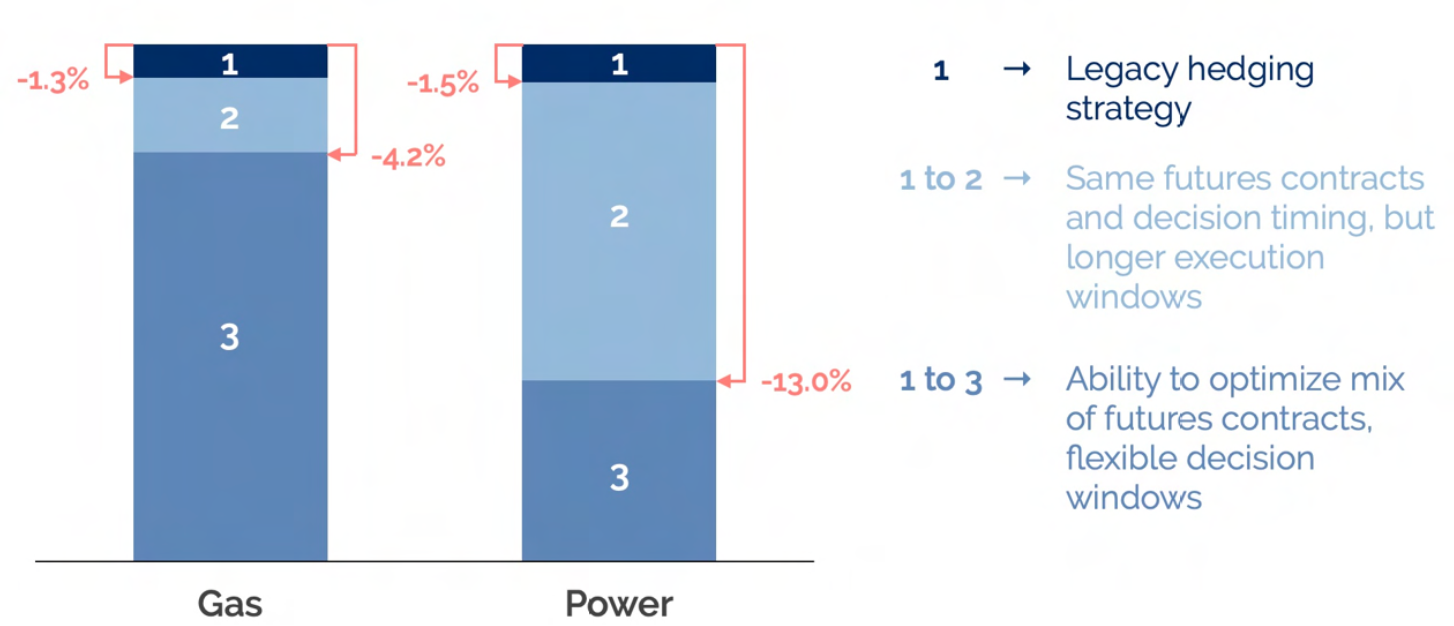

For example, a building materials multinational saved millions of euros in one European country, optimizing its hedging strategy with Datapred:

You could activate two main cost reduction levers:

- Decision windows. An interesting feature of energy hedging for industrial companies is that it offers them longer decision windows. When you are hedging for 2024, it doesn’t really matter if you buy the corresponding calendar futures in March or April 2022. Taking advantage of that latitude to optimize transaction timing based on market developments generates savings of ca. 1.5% in the example above.

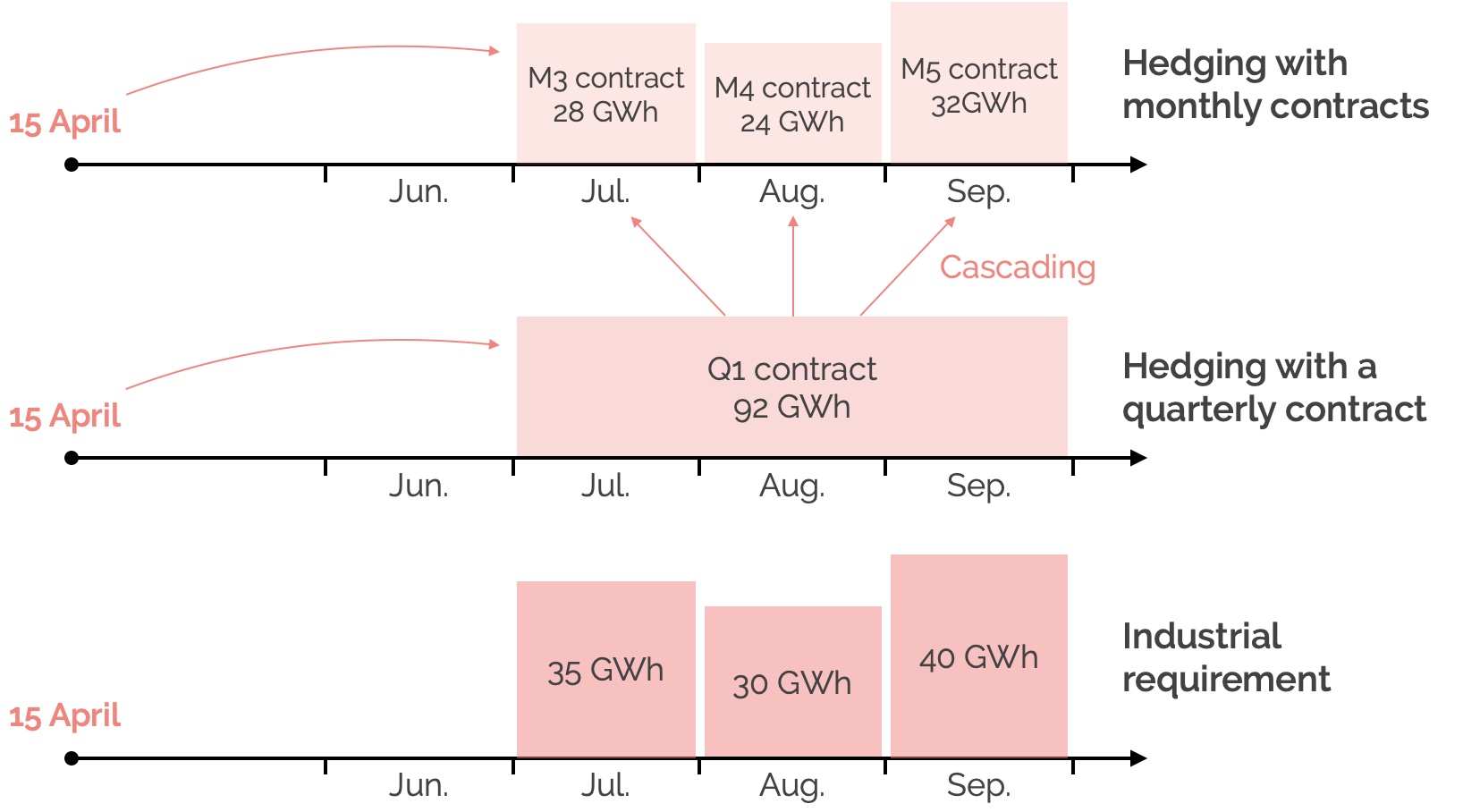

- Cascading. Dynamically playing with the full breadth of available futures contracts — also called « cascading » — is where the real savings potential is. In the example above, 4.2 to 13.0% compared to the legacy hedging strategy! In nature, optimizing the mix of futures contracts is similar to optimizing the proportion of spot and term-based transactions. The difference is more parameters in the optimization equation. Here is, for instance, what cascading would look like for a company hedging 80% of its quarterly requirement, one quarter in advance:

You clearly can’t do that by hand or with Excel — there are just too many decision factors: futures contracts prices and features, transaction costs, price limits, stop-loss rules, decision windows…

But you don’t need a quantum computer either. A classic linear solver, nimbly adapted to the specificities of energy procurement, will do a very nice job.

4. Combining spot and term-based transactions

In their 2018 annual report, ArcelorMittal (a Datapred client) commented, about energy and raw material procurement:

«Quarterly and monthly pricing systems have been the main type of contract pricing mechanisms, but spot purchases also appear to have gained a greater share as steelmakers have developed strategies to benefit from increasing spot market liquidity and volatility. »

That was quite prescient.

When markets are stable, term-based contracts are no-brainers. Their low maintenance cost far offsets the risk of not fixing the price at its absolute low.

Volatile energy markets create two significant drawbacks for term-based contracts.

- They prevent buyers from seizing short-term price opportunities. Even super-strong upward trends will have moments of weakness… We have seen that many times recently with European emission allowances. We are not asking industrial buyers to become financial traders and start reacting by the tick. Just to boost their ability to seize market opportunities:

- They don’t really suppress price risk — they just hide it for a while. But at some point you will have to contract again, and the more erratic the markets, the more uncertain the new contract. In some cases, US GAAP1 even require companies to place term-based contracts on their balance sheet at fair value with an offsetting entry to their income statement…

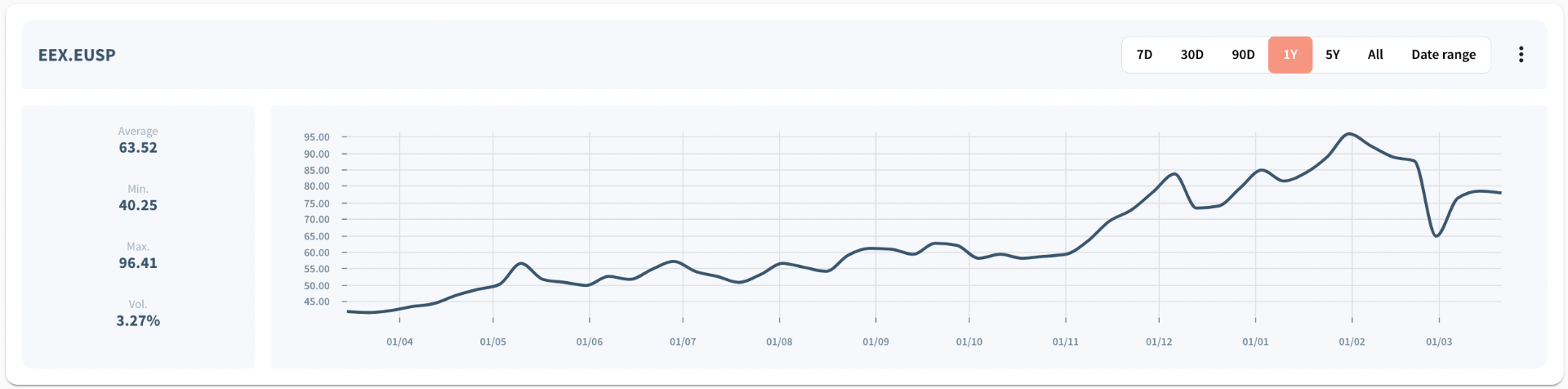

In our experience, when (i) price volatility exceeds 3% per week, and (ii) you could manage at least 2-3 buying decisions per month, you will benefit from increasing the share of spot transactions in your energy buying mix.

You will likely benefit from the flexibility of spot transactions when price volatility exceeds 3% per week and you can manage at least 2-3 buying decisions per month.

There are two ways to set that share.

- Basic: Just increase the share of spot transactions by 5-10% from its current level. See what happens, then adjust after a few months.

- Dynamic: Finding the optimal mix of spot and term-based transactions is a good example of the internal x external optimization challenges discussed earlier.

Conclusion

Times are hard for energy-intensive industries.

By all means continue to spend hundreds of millions on energy transition projects that will change your life ten years from now.

But be aware that investing a few hundred thousand euros in modern decision support solutions for energy buyers could yield millions in savings right now, without turning them into Gordon Gekko.

It’s all about facilitating smart but sensible buying and hedging tactics.

About Datapred

Datapred is a digital twin for industrial buyers of energy and raw materials.

Datapred helps buyers make better decisions, by providing a safe, connected space where they can test and monitor raw material and energy buying and hedging strategies.

Our digital twin offers buyers 360° visibility on market dynamics and price trends, their own buying performance, and the interplay between procurement and operations.

It also helps raw material buyers integrate non-financial goals into the buying strategy: emission reduction, asset maximization, product quality...

Datapred is a Gartner Cool Vendor, a SpendMatters Top 50 Company to Watch, a ProcureTech & Kearney Top 100 Innovator, a Laureate of the Swiss Foundation for Technological Innovation (FIT), and won Airbus’s worldwide machine learning challenge in 2019.